Enterprise Resource Planning (ERP) software industry overview and trends

Source: Äri-IT, spring 2023

Author: Marek Maido, BCS Itera Sales and Marketing Manager

In today’s world Enterprise Resource Planning (ERP) software has become indispensable for any competitive medium-sized or large company. Here is a comprehensive overview of what is currently happening in the world of ERP, along with experience-based insights specific to Estonia.

The article draws extensively from a comprehensive study done by TrustRadius (trustradius.com), which in turn draws on findings from a number of other studies in the field. Global statistics on the purchase and implementation of ERP mainly focus on the years 2020–2021.

93% of companies consider ERP implementation a success

ERP software successfully weathered the challenges of the COVID-19 pandemic both on a global scale and in Estonia. In total, 93% of businesses that implement ERP projects consider them a success. That success rate dropped by just 2% after the pandemic hit.

The primary challenges highlighted in regard to ERP software are its high cost, time-consuming implementation and frequent project budget overruns. Despite this, organisations across various industries have reported a positive return on investment (ROI).

ERP statistics

Microsoft Dynamics 365 was the ERP market leader in 2021 with a 49% market share

- 93% of businesses that implement ERP projects consider them a success (Panorama Consulting Group 2020).

- 47% of organisations did not complete their ERP projects within the expected timeline (Hubspot 2020).

- 45% of ERP projects go over budget (Selecthub 2021).

- Microsoft Dynamics 365 is the ERP market leader in 2021, holding 49% of the market share (TrustRadius 2021).

- 34% of the ERP market comprises investments by manufacturing companies (Hubspot 2020).

- 53% of customers are satisfied with their ERP system (Hubspot 2020).

In Estonia as well, Dynamics 365 and especially Business Central stand out as the fastest growing international ERP software – this assessment is based on the number of unique users (users identifiable by a computer). Smaller enterprises often opt for either local or scaled-down software solutions.

Market

- The global ERP market size was valued at $39 billion in 2019 (Allied Market Research 2019).

- The ERP market is projected to reach $86 billion by 2027 (Allied Market Research 2019).

I would like to highlight here the growth projection which indicates the rising role of the industry and ERP solutions in bolstering and amplifying competitiveness.

Winners

According to TrustRadius, more than 1.2 million potential buyers search for ERP software solutions each month. Let’s take a closer look at which products attract the most attention. The top six leaders in the ERP market are:

- Microsoft Dynamics 365 Business Central and Finance & Operations (commonly used in Estonia)

- Oracle Cloud ERP (less commonly used in Estonia)

- Sage Intacct (less commonly used in Estonia)

- Infor ERP

- Deltek Vision

- SYSPRO

- Microsoft Dynamics 365 (Business Central, Finance & Operations and Sales) is the ERP market leader in 2021, holding 49% of the ERP market share (TrustRadius 2021).

- Oracle Cloud ERP holds 18% of the ERP market share (TrustRadius 2021).

- Sage Intacct holds a 17% share of the ERP market (TrustRadius 2021).

- Infor ERP and Epicor each hold a 6% share of the ERP market (TrustRadius 2021).

Most common ERP software in Estonia

While specific statistics for Estonia are lacking, the argument can be made that this list does not fully reflect the current situation in Estonia. Dynamics 365 ERP software, particularly Business Central, holds a strong position here among medium-sized and large companies. However, the share of Oracle is minimal and the other solutions mentioned are almost nonexistent. In addition to Business Central and Finance & Operations, it is also worth mentioning SAP and Odoo as well as local solutions such as Directo and Erply. The share of these solutions is difficult to assess, though the size of companies could be used as a potential indicator. Microsoft and SAP dominate the market of medium-sized and large enterprises, while smaller and medium-sized companies opt for local solutions.

An overview of Business Central customers can be found at https://www.itera.ee/en/. Please keep in mind that this list is based only on one partner.

Challenges of ERP implementation

According to statistics, 50% of ERP implementations fail the first time around. It is essential to note that global statistics may not precisely reflect the circumstances in Estonia. For example, BCS Itera, who has implemented hundreds of complex ERP projects over the years, has a 100% success rate.,

While there have certainly been projects in which budget and schedule adjustments were made as needs became evident, these instances are exceptions rather than the rule. Nonetheless, Estonian enterprises are small within the global context, so the risks associated with ERP implementation in global enterprises do not materialise here.

99% of ERP projects implemented in Estonian enterprises are a success

- 50% of ERP implementations fail the first time around (TEC 2021). I am confident in asserting that the success rate of ERP projects in Estonia is around 99%, despite the absence of statistics for all partners.

- On average, ERP implementations take 30% longer than estimated (TEC 2021). This figure may be about the same in Estonia. While an optimistic estimate might range between 15–20%, it is important to note that this does not apply to all projects, as demonstrated in the subsequent point.

- 47% of organisations do not complete their ERP project within the expected timeline (Hubspot 2020).

- 65% of all organisations consider change management to be difficult or very difficult (Hubspot 2020).

ERP value and cost

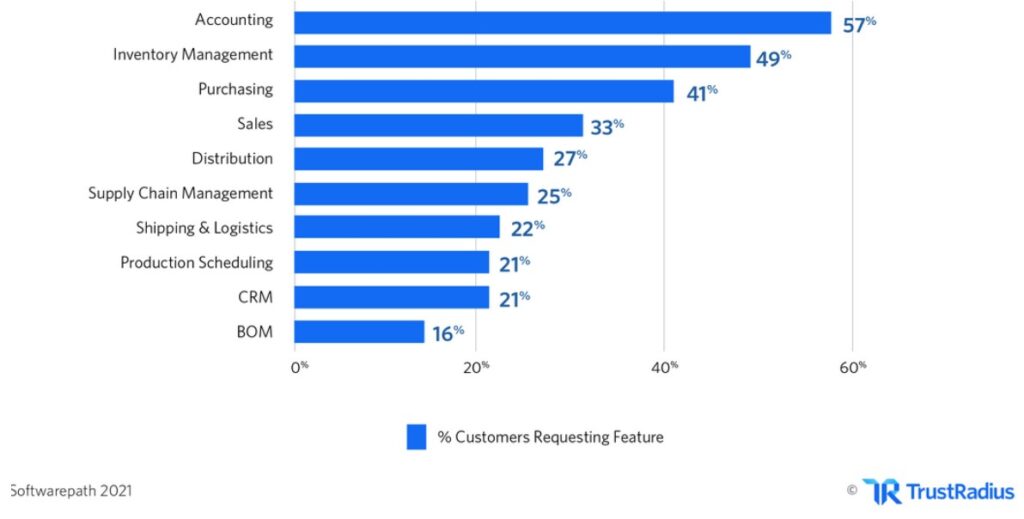

There are a number of reasons to invest in ERP software. The figure below provides a global overview, which is likely reflective of the situation in Estonia as well. An important aspect not reflected here is the desire to replace different solutions with a comprehensive solution that covers the entire supply chain to the greatest extent feasible. This guarantees improved data quality, reduced administrative costs and enhanced management reporting capabilities.

- 45% of ERP projects go over budget (Selecthub 2021). An important factor influencing the cost of a software project is the extent to which the customer is willing to contribute to the preparation and initial stages (analysis and design) of the project. Complex intricacies that lead to budget overruns often emerge during project implementation, revealing aspects that were not initially discussed. The percentage given above is likely similar in the case of Estonia.

- The average budget per user for ERP software is $8,265 (Softwarepath 2021). This figure is several times lower in Estonia. The more users of the solution a company has, the lower the average price. The second factor influencing cost is the extent and complexity of the solution, namely how comprehensive the coverage of all processes is.

How enterprises use ERP

- 25% of organisations implement ERP to increase efficiency (Softwarepath 2021).

- 20% of organisations implement ERP to support growth (Softwarepath 2021).

- 20% of organisations implement ERP to increase functionality (Softwarepath 2021).

Manufacturing accounts for 34% of the ERP market. Other major industry users include professional (accountants, architects, attorneys etc) or financial services (14%), distribution and wholesale (10%) and IT (5%). (Hubspot 2020)

The trend in Estonia is likely similar. The manufacturing sector has gained momentum largely thanks to the help of Enterprise Estonia, which supports the green transition with a number of measures.

How satisfied are customers with their ERP solution?

3% are very dissatisfied

7% are dissatisfied

38% are neutral

58% are satisfied or very satisfied

93% of organisations consider their ERP project a success (Hubspot 2020).

Change management often plays a key role here. Implementing new ERP software brings about a significant shift in daily operations, requiring learning and adjustment. In recent years, alongside ERP projects, there has been an increasing emphasis on investing in training, especially in change management. It is essential to consider that the implementation of modern ERP software does not always mean fewer clicks and an easier life – often the objective is to gather more data than before, which can mean an increase in input volume.

ERP hosting preferences

64% of organisations prefer to host ERP software on the cloud

- 64% of organisations prefer to host ERP software on the cloud (Softwarepath 2021).

- 34% of employees have no preference for hosting ERP software (Softwarepath 2021).

- 86% of ERP software is deployed as Software-as-a-Service or Saas (monthly/yearly instalment payments to license the use of a software; Hubspot 2020).

Looking at the example of BCS Itera, which primarily caters to medium-sized and large enterprises, it becomes evident that ever since 2019, a majority of these enterprises have opted for cloud-based hosting and the SaaS model. In light of this, it is reasonable to assume that the figures presented above are relatively similar in Estonia.

ERP usage

25% of employees use an ERP solution

- On average, 25% of employees use a company’s ERP system (Softwarepath 2021).

- 45% of employees in the distribution industry use an ERP (Softwarepath 2021).

- 44% of employees in e-commerce use an ERP (Softwarepath 2021).

- 43% of employees in the services sector use an ERP (Softwarepath 2021).

- 41% of employees in the non-profit sector use an ERP (Softwarepath 2021).

2021 ERP trends

Cloud

ERP boasts a substantial history and the increasingly rapid adoption of cloud applications is a trend that can be observed here as well. Only a mere 3% of organisations want to host on-premise ERP software. This is because customers implement ERP software to increase efficiency, support growth and expand functionality – cloud-based ERP solutions offer greater flexibility and opportunities in all of these areas. The rise of SaaS ERP and the general preference towards cloud-based software has made vendors focus on cloud-based solutions.

For instance, Dynamics 365 Business Central comes out with updates and a new version twice a year, offering cloud-based users a solution with an ever richer functionality.

Artificial Intelligence (AI)

The ERP market is currently experiencing a significant influx of AI features aimed at customising software to suit the specific needs of organisations. On the front end, chatbots and assistive interfaces are used to collect and process consumer information. On the back end, AI can be used to customise business processes. As AI technology improves, we expect this trend to continue.

In Business Central, AI can be harnessed to generate inventory forecasts, assess the payment behaviour of customers, automate marketing activities and much more.

Sources

- https://www.trustradius.com

- The 2020 ERP Report (Panorama Consulting Group 2020)

- ERP Case Study (Selecthub 2021)

- ERP Market Share, Trends & Growth (Allied Market Research 2019)

- ERP Statistics & Facts: ERP Success & Failure Rate (TEC 2021)

- The 2020 ERP Report (Hubspot 2020)

- The 2018 ERP Report (Hubspot 2018)

- The 2021 ERP Software Project Report (Softwarepath 2021)

- 45 Key ERP Statistics for 2021 (TrustRadius 2021)